Looking for

business funding?

Get a Business Line of Credit

that grows in funding

with your business.

Flexible funding, payments, and checking

built for business.

Looking for

business funding?

Get a Business Line of Credit

that grows in funding

with your business.

Flexible funding, payments, and checking

built for business.

Powering the small business economy

- True Line of Credit

- Nobody is Declined

- No Hard Inquiry

- No Personal Reporting

- No Personal Guarantee

- No Taxes or Statements

- Grows With Your Business

- Easy Auto-Repayment

- Builds Business Credit

Who Is 1st Merchants?

We are a Payment Processing Company with a

Unique & Easy Way to Finance your Clients

FIND OUT MORE IN THE VIDEO

Who Qualifies?

Any business with a merchant account

All Industries Except…

- Adult

- Gaming

- Marijuana

- Fix & Flip

- Insurance Brokers

How a business gets paid by Visa & MC

- Accept payments over the phone

- Accept payments over the internet

- Accept payments in person

What is a Merchant Account?

A merchant account is an agreement between a merchant and an acquiring bank. This agreement allows the former to process and accept credit card payments. By signing this agreement, a merchant agrees to abide by the operating regulations established by Visa, MasterCard, or any other brand.

No Merchant Account?

Don't have a Merchant Account?

Don't Worry, Leave it to us.

We set one up for your client

Why Merchant Processing?

By using a merchant account

- We can approve everyone

- We can give more funding

- We can automate repayment

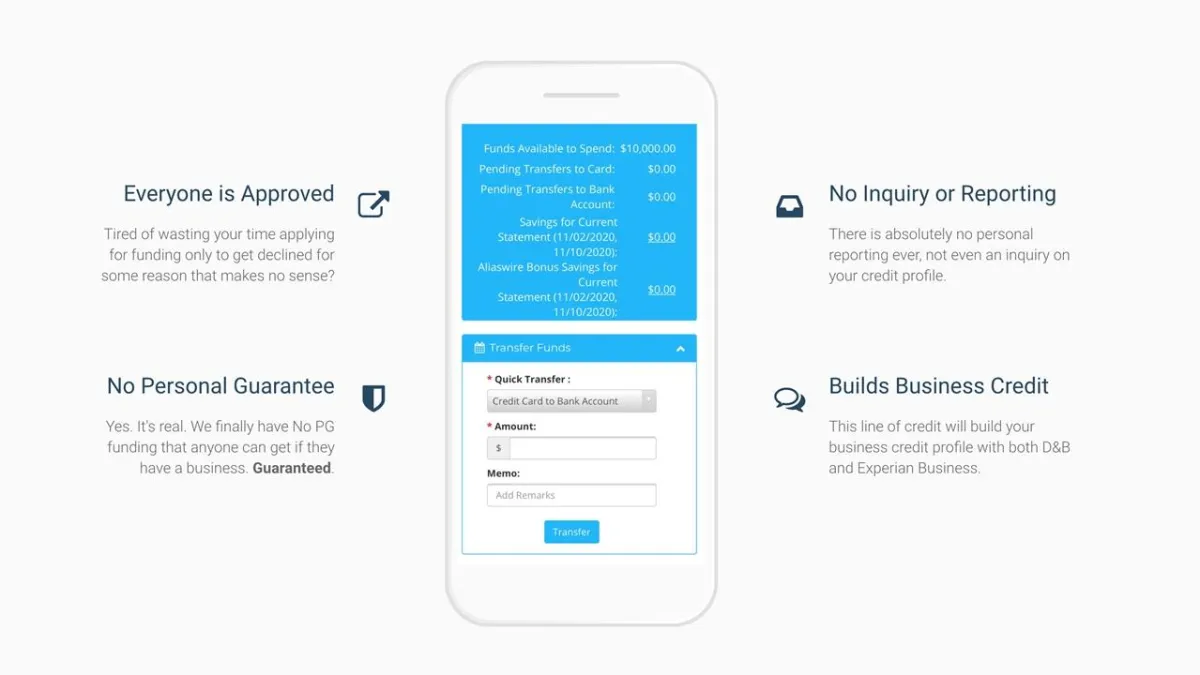

Nobody Is Declined

- Any business that can use a merchant account

- LOC linked with processing for repayment

- LOC limit can get larger every 3 months

No-PG Business Funding

- Credit Based: Up to $10,000 based on FICO9 Experian

- Processing: Up to $100,000 based on merchant processing

Setup Costs & Rates

- Setup: $99.97 merchant setup

- Monthly: $9.97 subscription

- Interest: 15% + Prime

Example Client

- Credit Based: $500 minimum 605 FICO

- Actual LOC: $75,000 based on merchant processing

WHY GET A MERCHANT LINE?

More than just funding, it's a complete cash-flow solution for your business

True Line of Credit

- Transfer funds directly to your bank

- Don’t pay a penalty interest rate

- Don’t need convenience checks

- Don’t need to ask permission

- Good interest rates (NOT MCA)

No Taxes or Statements

- No bank statements and tax returns*

- No profit & loss statements

- No insurance required

- No bank logins

- *Only required for a line increase requests

No Hard Inquiry

- Nothing appears on personal credit

- No score drops for inquiries

- No subsequent denials

True Line of Credit

No Taxes or Statements

No Hard Inquiry

True Line of Credit

No Taxes or Statements

No Hard Inquiry

- Transfer funds directly to your bank

- Don’t pay a penalty interest rate

- Don’t need convenience checks

- Don’t need to ask permission

- Good interest rates (NOT MCA)

- No bank statements and tax returns*

- No profit & loss statements

- No insurance required

- No bank logins

- *Only required for a line increase requests

- Nothing appears on personal credit

- No score drops for inquiries

- No subsequent denials

No Personal Reporting

- Keep your business and personal separate

- Won’t increase your personal debt ratios

- Won’t interfere with a mortgage next year

- Won’t get your personal cards closed

No Personal Guarantee

- Only financing where a startup can get funding without a PG

- Even in a worst-case scenario, you won’t lose your house

- This is TRULY UNIQUE

Grows With Your Business

- Can be increased every 3 months, keeps growing with you

- Not auto-reviewed, a bad month won’t hurt

- This is a Very unique

No Personal Reporting

No Personal Guarantee

Grows With Your Business

- Keep your business and personal separate

- Won’t increase your personal debt ratios

- Won’t interfere with a mortgage next year

- Won’t get your personal cards closed

- Only financing where a startup can get funding without a PG

- Even in a worst-case scenario, you won’t lose your house

- This is TRULY UNIQUE

- Can be increased every 3 months, keeps growing with you

- Not auto-reviewed, a bad month won’t hurt

- This is a Very unique

Easy Auto Repayment

- Automatically paid from merchant account

- Don’t have to worry about missed payment

- Easiest account you will ever have

Builds Business Credit

- Reports Positive Payments Only!

- Reports to D&B

- Reports to Experian Business

- Helps you get better funding over time

No Interest Expense

- If billed on the line and auto-paid within ~30 days, you have no interest expense!

- Most of our clients pay no interest at all

Easy Auto Repayment

Builds Business Credit

No Interest Expense

- Automatically paid from merchant account

- Don’t have to worry about missed payment

- Easiest account you will ever have

- Reports Positive Payments Only!

- Reports to D&B

- Reports to Experian Business

- Helps you get better funding over time

- If billed on the line and auto-paid within ~30 days, you have no interest expense!

- Most of our clients pay no interest at all

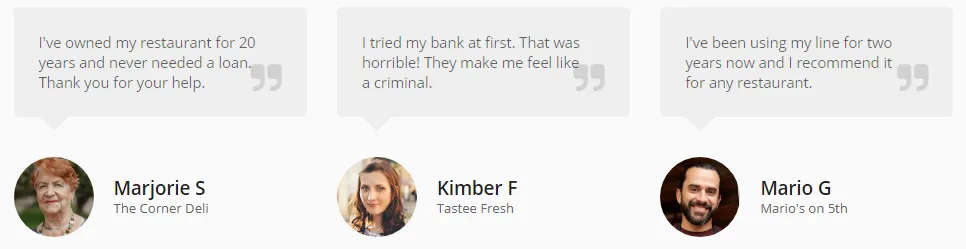

Here’s what business owners like you have to say

© Copyrights 1st Merchants Corporation. All Rights Reserved.